CHRISTMAS ORDERS ARE OPEN!

CLICK HERE TO PLACE YOUR ORDER.

Delivering for Christmas on the 22nd, 23rd and 24th of December, and for NYE on the 27th, 29th, 30th and 31st direct to your door.

Are you experiencing financial hardship and looking for ways to reduce your grocery bill?

Do you feel that the cost of groceries is getting out of hand and overwhelming you? Especially given the state of the economy, where food prices are rising excessively.

Admit it! You’ve frequently entered a store with a list of items in hand and left with more than you intended to buy. We’ve all bought asparagus without knowing what to do with it, forgotten about an avocado or two in the fridge, and stocked up on sauces and relishes that we suddenly realised past their sell-by dates.

Your budget will always suffer if you indulge in excessive spending. According to financial experts, if you want to live a financially healthy life, you should avoid going over your budget and accruing large amounts of debt.

Overspending can also keep you from achieving your financial objectives. According to personal finance experts, overspending can drive more people into high-interest credit-card debt when combined with rising inflation and interest rates.

What causes people to overspend? One major factor is that many purchases are made on impulse.

A startling 76% of purchases are made by customers already in the store’s aisles. 57% of buyers ultimately spent more money than they had planned to as a result.

This is because decisions made in stores are subject to unforeseen circumstances. A hungry shopper is more inclined to excuse the purchase of more food than they may genuinely require.

Making a plan in advance is one method to reduce impulsive spending, and a shopping list needs to be more comprehensive. Make a budget to ensure you only spend what you intend to. Some consumers only have the exact amount of cash they’re supposed to have on them, so even if they’re tempted to spend more, they need more funds.

Maintaining a diet that is only organic will be highly expensive. Investigate which fresh foods are best purchased organically and which are less impacted by their non-organic origins. For instance, purchasing organic produce for fruits and vegetables with fragile skins or whose skin is typically consumed is better. Pesticides have less impact on produce with tougher skin, shells or husks, or skin typically peeled and thrown. Consider your options carefully before hopping on the health food bandwagon; even though you spend $50 a week on the newest superfood, your body will still need to be indestructible.

Being sociable creatures, turning down invites to events like parties or meals may be challenging. One way to stop compulsive expenditures is to discuss our financial goals with people who can relate to the issue. However, it could be time to find a new group of friends if your friend’s concept of fun always entails spending money, they make rude remarks about your car (or other assets), or they don’t respect your spending plan.

Many people think that if they don’t “keep up with the Joneses,” society won’t view them positively. The wisest course of action is to live up to your standards rather than those of society because society does not cover your expenses.

Most families spend more than they should because they want to stay in touch with their friends and family. To impress others, one shouldn’t overspend or excess. Recognise that spending should be within your ability to pay them back.

Most individuals are only aware of how much of a problem boredom can be once it is brought up, which is a crucial factor in overspending. Unfortunately, because it takes an incredible amount of self-control and effort to prevent boredom, this is one of the most challenging causes of expenditures to overcome.

It’s best to identify the circumstances that lead to boredom and try to fill them with a more productive habit, such as beginning a side business, getting a part-time job, or trying to create your venture. Most of us are impulsive spenders who make purchases without planning or considering the consequences of our actions. Spend solely on items and services you will need immediately or shortly. Limit impulsive spending and put off making same-day purchases.

People using credit excessively is another factor in their excessive spending. When paying with credit, many customers frequently overlook the receipt before signing their name. However, using cash when making a purchase is a psychologically proven, surefire way of being made very aware of how much money you’re parting with, a phenomenon of consumer behaviour known as “the pain of payment.”

According to a study, persons who typically pay for their purchases with credit cards are likely to overspend more than those who pay with cash or checks. Experts advise people to only use their credit cards for emergencies or significant expenditures and to never spend more than 33 per cent of their credit limit.

Spending money may be thrilling and pleasurable. Purchasing a gift for yourself can make you feel better when you’re depressed and can help you forget about your worries when you’re concerned. If you have cause to rejoice, you should commemorate the occasion with a gift. These situations may be acceptable if they are minor, but if you go overboard, your budget may suffer. Emotional spending might cause us to make poor financial judgments and push us to purchase items we don’t need.

Have you ever been approached by a friend or coworker and suggested a fun activity? Although everyone enjoys going out and having a good time, you must be sure it is in your best financial interest. Everyone should have fun, but it’s crucial to know when to say “no.” It can be simple to merely use your credit card to pay for an evening out to eat or see a movie, but if you don’t pay it off each month, you’ll be paying for that evening for a very long time.

If it is outside your budget, don’t risk your financial future to indulge in a few today. Keep going if you know you can’t afford anything. Instead, have a dinner party, game night, or other events where you can still spend time with your friends without going over budget.

People overspend for a variety of reasons. One person’s motivations for overspending may not be the same as another’s. It sometimes needs to be clarified why you might overspend one month or accrue significant debt the following.

You may take charge of your finances and prevent overspending by being aware of how much you can afford to spend, using a budget, and reflecting on when and why you are prone to overspending.

Have you ever noticed how much of your total spending goes towards groceries? Most families and households spend a lot of money on grocery shopping, but there are ways to reduce this cost.

Here are some useful grocery shopping tips you should follow.

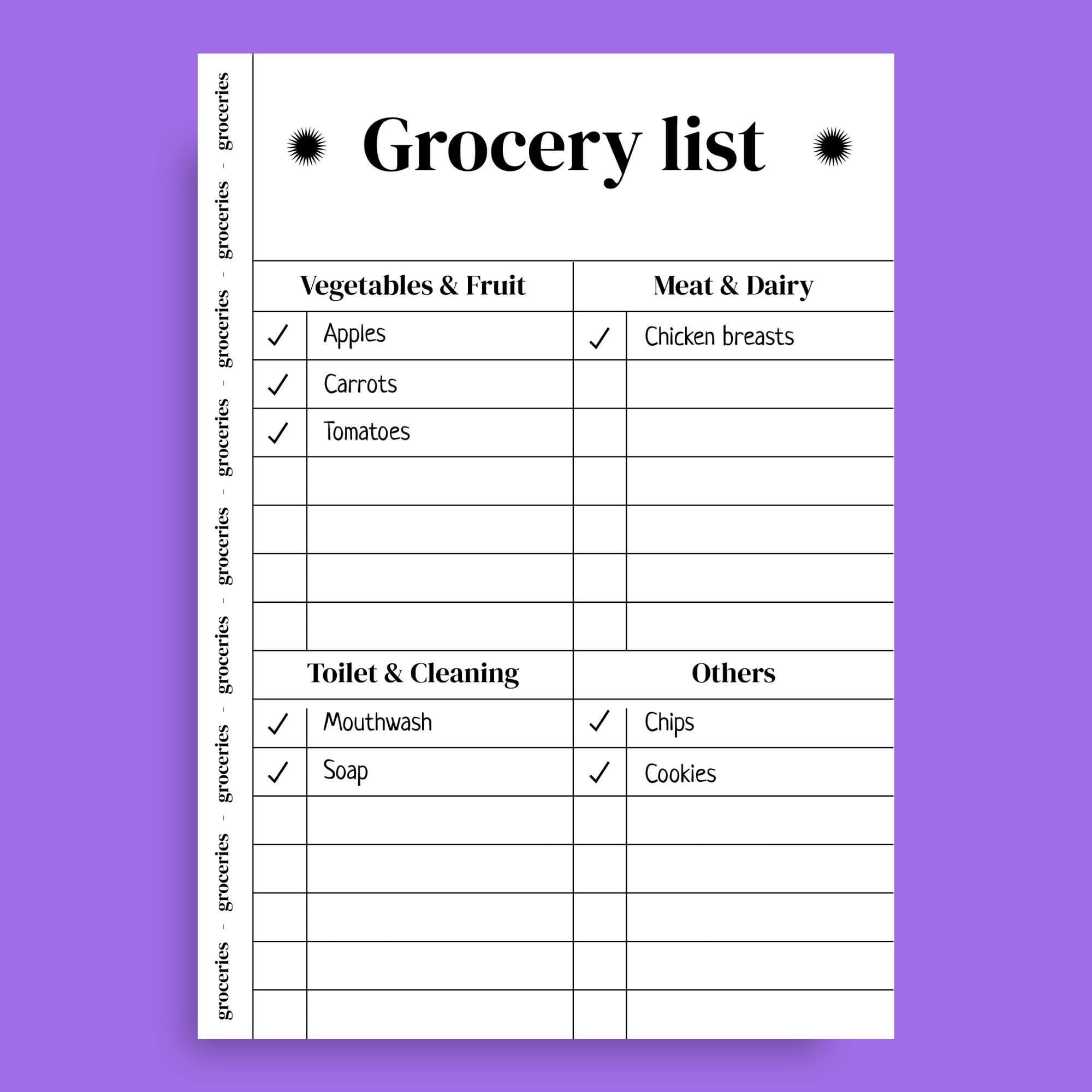

Making lists is not most people’s favourite activity. But they function flawlessly. Keep a notepad handy—you can even purchase specialised cost monitoring notebooks—and list anything about to expire. When you go shopping again, bring this list with you and keep to it as much as possible. Keep lists separated into perishables and non-perishables if you’re a perfectionist.

Simplicity is essential when it comes to grocery shopping on a tight budget. A sophisticated recipe can easily consume a whole week’s budget due to the sheer volume of ingredients needed. Pick a few grand, straightforward dishes that only require up to five ingredients if you want to start saving money on shopping.

Even better, choose recipes that use some of the same components when selecting the meals you want to prepare for the upcoming week. Long-term savings will result from this because shopping in bulk is typically less expensive—but only if you eat everything you purchase!

Meal planning is crucial if you’re serious about grocery shopping on a tight budget. Make sure you know exactly what you’ll be eating that week before you go shopping so you can estimate your predicted costs before you start spending.

This lowers your risk of going over your budget and inspires you to go outside the box when planning the meals you’ll make that week.

Look through your refrigerator or pantry to see what meals you can assemble with your current ingredients. When you have some delicious chicken thighs stuffed in the back of your freezer and some unopened cans of salsa and black beans on your shelf, who says you need to stock up on more groceries? Using the food you already have will save a lot of money even if you still need to buy a few things.

Although convenient, online grocery services and subscriptions can be expensive. It’s only sometimes possible to locate the exact size you’re searching for online, so you might have to trade up to a larger size for a more excellent price. Furthermore, third-party vendors at Amazon sometimes fill orders for groceries, which can come with shipping fees, raising your bill.

There are optimum storage instructions for every product; some must be kept in dry locations, dark containers, etc. To ensure that your ingredients endure until you are finished using them, follow those guidelines. For instance, bread can only be left out for a short time, so buy smaller loaves unless your family is a big fan of bread. If there is any leftover, you may reheat it in the toaster after being chilled for a day or two. Be mindful of the use by date of the items you spend money on to ensure that they are still safe for consumption.

When buying in bulk genuinely results in financial savings, it’s fantastic. However, you shouldn’t automatically believe that bulk buying at bargain retailers will be less expensive. Compare prices per unit or ounce for the item you’re purchasing when grocery shopping on a tight budget. Being mindful of the unit price can greatly help you in budgeting your pantry staples.

Only buy what you need, especially when it comes to perishable things, despite how alluring it may be to store up. If you have a family of four, buying bulk cereal might be a wise investment, but if it’s just you, you should pass on the 40-count container of Greek yoghurt.

Timing is everything when it comes to acquiring a good deal. According to several experts, buying food on Wednesdays is more affordable. That’s because grocery retailers refresh their shelves in the middle of the week and mark down items that weren’t popular the previous week. However, they’ll occasionally give you the price reductions from last week’s sale because they’re adjusting the discounts. Try to avoid the weekends if going on a Wednesday is not feasible. Fewer deals result from larger crowds.

Deals are greatly influenced by the time of day, and early birds get the first go at the discount racks! Shopping just before closing time, when the deli and bakery counters are attempting to sell off the remainder of their stock, is another excellent opportunity to earn significant discounts if you’re a slow shopper.

It can be challenging to chop fruits and vegetables, but you pay much for the convenience of having the grocery store do it for you. You’ll save a lot of money if you DIY rather than buy the pre-cut fresh fruit and jar of perfectly julienned carrot sticks for your vegetarian meals. Additionally, since pre-cut fruits are frequently the source of listeria outbreaks, you might save yourself a dance with a deadly infection. You can prepare multiple meals for the same grocery prices you regularly spend and be sure that you and your family are consuming only fresh food.

Do you recall that we advised you to ignore the prepared food section? Rotisserie chickens, however, are a notable exception. One of the few meals frequently more expensive to prepare at home is a whole, roasted chicken. The main reason is that most supermarkets reduce food waste and make money by roasting raw chickens from the butcher counter when an excess won’t sell. As a result, you benefit from significant financial and time savings over roasting your own.

Remember this tried-and-true advice when looking to reduce your grocery spending. Avoid going food shopping when you are hungry. This old piece of wisdom is excellent counsel because it is effective. If you go grocery shopping after a meal, you’ll generally avoid making any impulse buys, which can significantly increase your food price.

Consider whether you can buy a lot of an item and keep it for a long time whenever you locate an excellent offer. By doing this, you can be sure that the goods will be in your cupboard and that you also received it at a lower cost. Additionally, you can’t ensure the price will stay the same, so stock up on discounted supplies if you can.

You may reduce your monthly grocery costs, stay within your budget, and reach your financial objectives more quickly by forming a few new habits. That means you’ll have more money towards debt repayment, future investments, or fun purchases like a babysitter and a lovely meal out where the cooking and cleanup are taken care of!

Try one of these money-saving tips on your next trip to the grocery shop now that you know how to save money on food. The amount of money in your pocket may surprise you, and you might also develop a lot more culinary creativity and that’s how to save money on groceries.